Understand the advantages and limitations of copy trading, and how Tradesyncer puts you in control

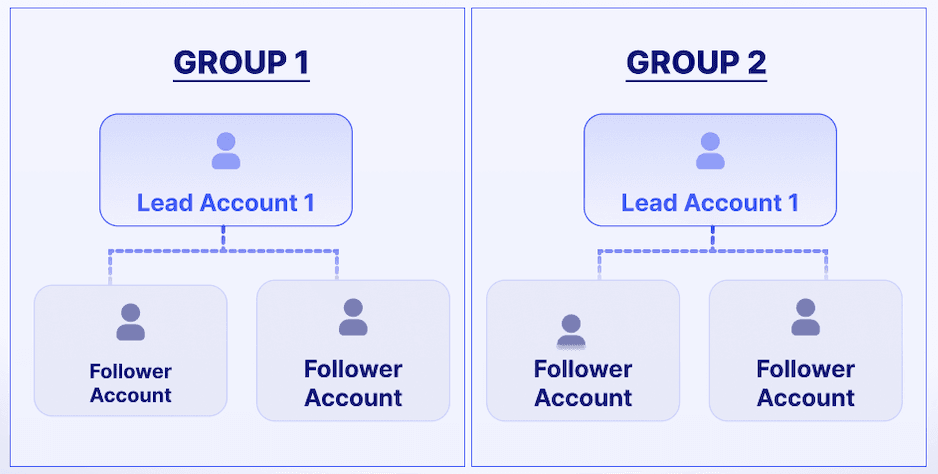

Copy trading isn't about following strangers or handing over your account to someone else. With Tradesyncer, copy trading means mirroring your own trades from one lead account to multiple follower accounts. This happens instantly, accurately, and without extra manual input. It's the tool with built-in risk management and automated trading journal software serious traders use to scale their performance across prop firms and live accounts with maximum consistency and minimum effort.

Copy trading with our trade copier offers a powerful way to streamline your trading operations by allowing you to execute the same strategy across multiple accounts in real time. Below, we explore the key advantages that make copy trading a smart choice for experienced traders looking to expand their impact without adding complexity.

With a trade copier like Tradesyncer, you can trade on a single account while replicating those same trades across dozens – or even hundreds – of connected accounts. This means you can scale your strategy to meet the requirements of multiple funded accounts or prop firm challenges without executing the same trade multiple times.

Every entry, exit, and modification is copied with lightning-fast speed – often in less than 100ms – thanks to our cloud infrastructure. That ensures all your accounts follow the same logic, without delays or human errors.

Manually managing multiple accounts is exhausting. Copy trading eliminates repetitive tasks and frees you up to focus on your strategy, trade planning, and risk management. No more switching tabs or re-entering orders.

Our copy trading platform includes built-in risk management software, allowing you to apply consistent stop-loss settings, trade limits, and even lockout features across all connected accounts. With our trade copier you stay in control at every moment.

Our trade copier is designed for traders who already have the expertise, not beginners looking to follow someone else's trades. This makes it ideal for prop firm traders, fund managers, and professionals who need reliable infrastructure and precision.

While copy trading can be a game-changer for active traders, it's not without its limitations. Understanding the potential drawbacks helps ensure you're using copy trading tools like Tradesyncer wisely and effectively. Here's what you need to watch out for before fully committing.

Copy trading doesn't improve your trading, it amplifies it. If you're not consistently profitable or disciplined, copying your trades across multiple accounts can multiply your losses just as fast as your wins. Tradesyncer puts the tools in your hands, but you still need a good strategy.

Although Tradesyncer is cloud-based and doesn't require any installations or VPS, you still need to make sure your accounts are properly connected and configured. Mistakes in settings – like follower ratios or risk parameters – can affect your results.

Even with built-in risk management, trading futures and other leveraged instruments always carries risk. If the master account experiences a drawdown, every linked account will reflect that. That's why we've built advanced control settings, but ultimately, the responsibility is still yours.

Unlike generic copy trading tools, Tradesyncer was built specifically for prop firm and multi-account traders who already have their strategy and just need the infrastructure to scale. Here's how we help:

Connect, manage and activate your accounts to enable them for seamless copy trading.

Full control from lead to follower accounts. Manage trading settings for a smooth experience across multiple accounts.

With our global infrastructure, we ensure your trades are executed with minimal latency worldwide.

Protect your capital with automated risk controls. Lock out accounts based on time and sessions.

Comprehensive journaling modules with advanced analytics.

See what real traders are saying about their experience with Tradesyncer.

Copy trading can be a powerful way to scale your trading results, but only if you're already trading with discipline and consistency. For professionals managing multiple accounts, copy trading with Tradesyncer means faster execution, better consistency, and the ability to apply risk rules across every setup.

Looking to take your multi-account trading to the next level? Start your free 7-day trial and see how our trade copier helps you trade smarter across every account.

Start Free TrialTradesyncer is built on transparency and trust. We implement robust security measures to ensure our trading platform and infrastructure are safe and reliable. Our commitment to data protection and global compliance standards keeps your trading information secure at every step.